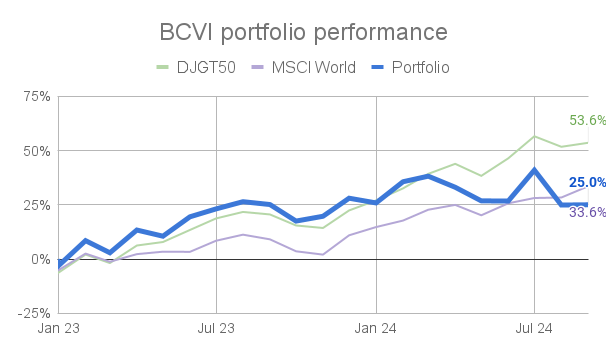

The BCVI portfolio is built using our blue chips value investing strategy. It invests in undervalued American and European blue chip stocks that exhibit a competitive advantage. To identify such investment opportunities we use a combination of quantitative and qualitative techniques. Since its inception in December 2022, the portfolio has generated a total return of 25% (13.6% annualized). To benchmark the BCVI portfolio performance we use the Dow Jones Global Titans 50 (for its close relevance) and the MSCI World (as a go-to recommendation for effortless passive investing).

BCVI Portfolio performance

| last month | trailing twelve months | since launch | 2023 | |

| BCVI portfolio | +0.1% | -0.1% | +25.0% | +28.0% |

| Dow Jones Global Titans 50 | +1.2% | +27.4% | +53.6% | +22.4% |

| MSCI World | +4.1% | +22.4% | +33.6% | +10.9% |

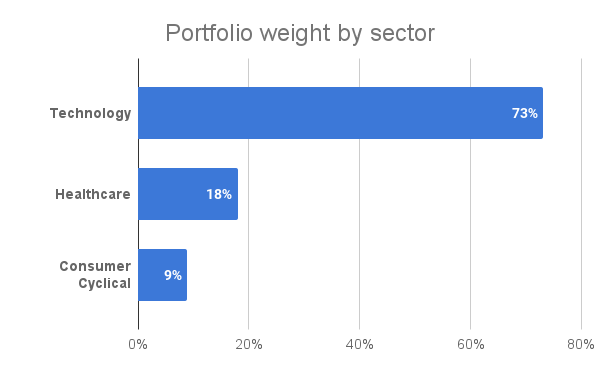

Asset allocation

| Holding | Portfolio weight | Sector |

| Microsoft Corporation | 26% | Technology |

| ASML Holding N.V. | 22% | Technology |

| Adobe Inc. | 25% | Technology |

| Pfizer Inc. | 18% | Healthcare |

| Kering SA | 9% | Consumer Cyclical |

Performance of current portfolio positions

Adobe Inc. (ADBE)

This position was added to the portfolio on Dec 2, 2022. At the date of purchase the share price was 327€ and the estimated fair value was 701€, providing us with a margin of safety of 53%. The stock is currently trading at 519€ with an estimated fair value of 665€, leaving an upside potential of 22%. Last month, the share price rose by 8% compared to the previous month. Since its purchase, share price has risen by 59% and over the trailing twelve months share price has declined by 1%, respectively.

ASML Holding N.V. (ASML.AS)

This position was added to the portfolio on Dec 2, 2022. At the date of purchase the share price was 577€ and the estimated fair value was 1,026€, providing us with a margin of safety of 44%. The stock is currently trading at 769€ with an estimated fair value of 809€, leaving an upside potential of 5%. Last month, the share price rose by 4% compared to the previous month. Since its purchase, share price has risen by 34% and over the trailing twelve months share price has increased by 25%, respectively.

Kering SA (KER.PA)

This position was added to the portfolio on Dec 27, 2022. At the date of purchase the share price was 486€ and the estimated fair value was 806€, providing us with a margin of safety of 40%. The stock is currently trading at 253€ with an estimated fair value of 440€, leaving an upside potential of 42%. Last month, the share price declined by 7% compared to the previous month. Since its purchase, share price has declined by 48% and over the trailing twelve months share price has fallen by 48%, respectively.

Microsoft Corporation (MSFT)

This position was added to the portfolio on Dec 27, 2022. At the date of purchase the share price was 226€ and the estimated fair value was 377€, providing us with a margin of safety of 40%. The stock is currently trading at 371€ with an estimated fair value of 445€, leaving an upside potential of 17%. Last month, the share price declined by 1% compared to the previous month. Since its purchase, share price has risen by 64% and over the trailing twelve months share price has increased by 22%, respectively.

Pfizer Inc. (PFE)

This position was added to the portfolio on Jan 10, 2024. At the date of purchase the share price was 27€ and the estimated fair value was 44€, providing us with a margin of safety of 40%. The stock is currently trading at 26€ with an estimated fair value of 33€, leaving an upside potential of 22%. Last month, the share price has declined by 8% compared to the previous month. Since its purchase, share price has declined by 4%.

Last updated on September 14, 2024.