Financial statements with their wealth of information and technical jargon can be intimidating to fledgling investors wanting to understand if a company presents a great investment opportunity. But hidden in that heap of financial data are powerful indicators that can tell us if a business is in great shape. Learn how to analyze financial statements to identify companies with a durable competitive advantage that can generate outstanding returns.

Introduction

When I began active value investing I started – like many others – by attempting to calculate the intrinsic value of a company to determine whether a company was undervalued and hence cheap. When I had found a cheap one, my next goal was to understand and gauge the health and substance of the business. To do that, I followed the advice in the book Warren Buffett and the Interpretation of Financial Statements: The Search for the Company with a Durable Competitive Advantage and looked at a company’s margins, its return on equity, its debt and other indicators. And what I found was that two out of three times the companies were cheap for a reason: Like car manufacturers with their low margins, high debt and capital intensive manufacturing process. Or companies like Nokia whose glory days are long gone.

Frustrated by the many hours I had spent valuing companies that didn’t turn out to be great investment opportunities in the end, I decided to turn the process on its head. I went through the book again and picked the factors that were

- easy to comprehend

- required low effort for gathering the information

- and had a clear point of reference for what great performance looks like.

The result was a set of 12 expressive indicators and a simple, mechanical scoring system that provide a comprehensive picture of the state of the business and are derived from the three standard financial statements of public companies: The income statement, the balance sheet, and the cash flow statement.

This has become the first step of my strategy for evaluating stock investment opportunities because of its speed and simplicity. Using a spreadsheet template and the free information available on Yahoo finance I can now assess within a couple of minutes if a company is a great business and a potential investment opportunity that is worth the time and effort for a detailed analysis. In this article, I walk you through the process step by step – with explanations and illustrating examples.

Analyzing the income statement

Let’s start with the income statement, sometimes also called P&L statement for profit and loss. It shows how successfully a company has operated during a period of time – typically a year. The three main components of the income statement are revenues, expenses and earnings and it is structured from top to bottom in that order. This is also the origin of the business terms “top-line” (revenues) and “bottom line” (profit or earnings). Conceptually simple, real income statements can have many line items that can make retail investors miss the forest for the trees. However, in order to assess if a company is in great shape and a promising opportunity for a promising investment we only need four bits of information:

- Revenue

- Gross profit

- SG&A expenses

- Net income

From these, we will compute 6 performance indicators that will help us gauge the potential of the company by answering these questions:

- Is the gross margin high and consistent?

- Are SG&A expenses low?

- Is the net income growing and consistent?

- Is the net margin high?

Gross margin

- What is it: Gross margin is the percentage of revenue that a company keeps after accounting for the direct costs of selling a product (or service) such as raw material or labor.

- How to compute it: Gross margin is the ratio between gross profit and revenue.

- Why it is important: The higher the gross margin, the more money the company retains from their sales, which it can use to invest into growth or to pay other costs. A high gross margin is also indicative of a competitive advantage because it allows the company to ask high prices for its products.

- What we are looking for: Ideally we want the gross margin to be high and consistent. A gross margin of 20% is good, more than 40% is great. In order to judge consistency, we can look at the change of the gross margin over time.

Let’s illustrate that with an example: Visa – a payment provider best known for its credit cards. Using the income statement in the Financials section of Yahoo finance, we can easily find the data we need: revenue and gross profit for the past four years (which was the period 2020 to 2023 at the time of writing):

| in $1000 | 2023 | 2022 | 2021 | 2020 |

| Revenue | 32,653,000 | 29,310,000 | 24,105,000 | 21,846,000 |

| Gross profit | 26,086,000 | 23,577,000 | 19,135,000 | 17,334,000 |

| Gross margin | 79.9% | 80.4% | 79.4% | 79.3% |

We find that the average gross margin of the last four years was 80% – a great result and well above the 40% mark. It is not all that surprising, since Visa is providing a service, thus there aren’t many direct material or labor costs involved. In contrast, a company like PepsiCo, selling food, snacks, and beverages, has a lower (but still great) gross margin of 55% and a material and labor intensive business like Boeing is closer to 5%.

In order to judge consistency of the gross margin we can start with a visual inspection: In those four years the gross margin varied only between 79.3% and 80.4% – rather consistent. An easy way of quantifying the consistency is the coefficient of variation – a normalized measure of the spread of data points. We can obtain it by dividing the standard deviation of our data points by their average value. So for our Visa example we get:

- Average gross margin = 79.8%

- Standard deviation = 0.5%

- Coefficient of variation (CoV) = 0.6%

The numbers confirm our visual impression and we have a more objective way of measuring it. In general, values below 10% can be considered consistent. As a counter example, let’s look at the CoV of Visa’s revenues during that period. We can see that revenue grew steadily from $22bn in 2020 to $33bn in 2023. So we’d expect a lot more variation. Using the same steps a before, we get:

- Average revenue during the period = $26.98bn

- Standard deviation = $4.91bn

- Coefficient of variation = 18%

So indeed, Visa’s revenues showed a much higher degree of variation due to the growth. What that tells us is that the company is actively managing their profit margin to be close to a predefined target value (~80%) by managing their costs in relation to the revenue they are generating every year.

SG&A expense rate

- What is it: Selling, general and administrative expenses (SG&A) includes all the overhead expenses required to run the business that are not directly related to producing the products or services.

- How to compute it: The absolute expenses aren’t relevant, but the percentage of gross profit that gets spent for SG&A. Hence, we are looking for the ratio between SG&A expenses and gross profit.

- Why it is important: Overhead expenses are rather fixed, thus should the company experience lower sales (revenue) in a year, they will eat up the profit and reduce the earnings because they can’t be scaled down easily. In addition, companies in highly competitive industries and without a durable competitive advantage, are forced to spend a lot more, e.g. on Marketing, in order to remain relevant for the customers.

- What we are looking for: The lower the better. SG&A expenses of 30% or less of gross profit are great, but even values up to 70% are acceptable and common, even for companies with a competitive advantage.

For our running example – Visa – we find that they spend on average 13% of their gross profit for SG&A expenses – an excellent result. In contrast PepsiCo has to spend about 74%, a result of the strong competition in the food and beverage market.

| in $1000 | 2023 | 2022 | 2021 | 2020 |

| Gross profit | 26,086,000 | 23,577,000 | 19,135,000 | 17,334,000 |

| SG&A expenses | 3,216,000 | 3,035,000 | 2,524,000 | 2,475,000 |

| SG&A expense rate | 12.3% | 12.9% | 13.2% | 14.3% |

| in $1000 | 2023 | 2022 | 2021 | 2020 |

| Gross profit | 49,590,000 | 45,816,000 | 42,399,000 | 38,575,000 |

| SG&A expenses | 36,677,000 | 34,459,000 | 31,237,000 | 28,453,000 |

| SG&A expense rate | 74.0% | 75.2% | 73.7% | 73.8% |

Net income and net margin

- What is it: Net income (sometimes also called net earnings) is the proverbial “bottom line” on the company’s financial statement. It’s the part of the earnings that remains after all costs, expenses and taxes have been paid.

- How to compute it: Net income can be taken directly from the income statement. If you are using Yahoo finance to get the data, you’ll notice that there are several items labeled “net income” and that it is not actually located at the bottom of the table. We are interested in the item called “Net income from continuing operations”. This excludes unusual and irregular income as well as income from discontinued operations, which is exactly what we are looking for as we are interested in the strength of the core business. Net margin is computed in the same way as gross margin, only this time we take the ratio of net income to revenue.

- Why it is important: In order for us to gain from our investment, the company itself needs to operate profitably and do so continuously, especially if we are looking for a long term investment. Furthermore, net earnings will become the basis for two more performance indicators that we will derive from the balance sheet and the cash flow statement in a moment.

- What we are looking for: When it comes to net earnings we are interested in continuity and an upward trend. To assess this, we have to look at several years of performance data. The result of a single year is not enough. Continuity is easy to judge: If there have been years with losses, then the income hasn’t been continuous. To ascertain whether there is an upward trend, there are several options: We could use the compound annual growth rate (CAGR), but that one has the drawback that it only considers two data points, the first and the last year, and is therefore sensitive to any deviations from the underlying trend in these years. Another straightforward approach could be to compute the year-over-year growth and average the outcomes. Personally, I prefer to use linear regression to compute the growth indicator because it is a solid statistical method and it produces an optimal result (in the sense that the estimation error is minimized). While it may sound daunting at first, it is actually very easy to do using common built-in functions of spreadsheets as we’ll see in the example below.

As with the gross margin, we also want the net margin to be high. But since a lot more costs and expenses have been deducted, our expectation for what constitutes a high margin is naturally lower. As a guideline, a margin of more than 20% is great and likely indicative of a company with a strong moat (another term for competitive advantage). On the other hand, less than 10% is an indication of a highly competitive industry. Let’s see how the company we are analyzing is performing:

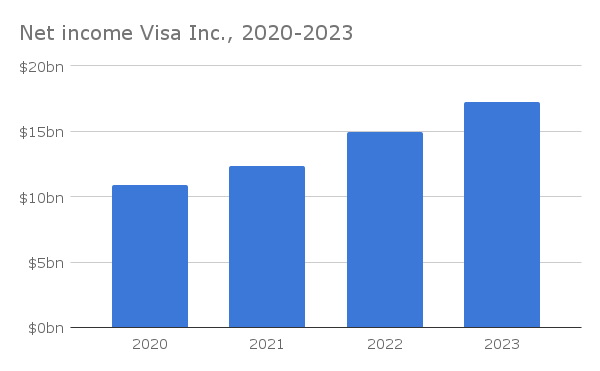

| in $1000 | 2023 | 2022 | 2021 | 2020 |

| Revenue | 32,653,000 | 29,310,000 | 24,105,000 | 21,846,000 |

| Net income | 17,273,000 | 14,957,000 | 12,311,000 | 10,866,000 |

| Net margin | 52.9% | 51.0% | 51.1% | 49.7% |

The first thing we can observe is that Visa is showing the continuity that we are seeking – earning a juicy profit in all these years and posting no losses. We also see that the net margin is very high: 51% on average during these four years, which is well above the 20% mark for great companies. Looking at the net income numbers we can also see that it is growing, which is what we are seeking. In order to quantify the growth in a single number, let’s do the math step by step:

- Compute the average net income – for Visa that amounts to $13.85bn per year for the period 2020 to 2023.

- Compute the slope of the line fitted to the annual net income values. To do that we can use a built-in function. For google sheets (which is what I am using) that function is called SLOPE. Applying it we find that the income grows by $2.19bn per year.

- Compute the annualized growth rate by dividing the slope by the average value: 2.19 / 13.85 = 16%.

You may ask yourself “What is the benefit of going through the calculations for growth if I can just eyeball the trend from the numbers?”. There are actually three:

- Calculating it makes it concrete, quantitative and objective. This becomes particularly useful for deciding edge cases in a consistent and efficient way: Is 0.1% growth sufficient to conclude that the earnings of a company show an upward trend? Or does it need to be more than 5%? (I use 1% as my cut-off)

- While you could plot the data and do a visual judgment (we humans are great at that) codifying it into a formula is much quicker. And when you are pouring through dozens of companies in order to find the opportunity needle in the haystack being quick and efficient matters.

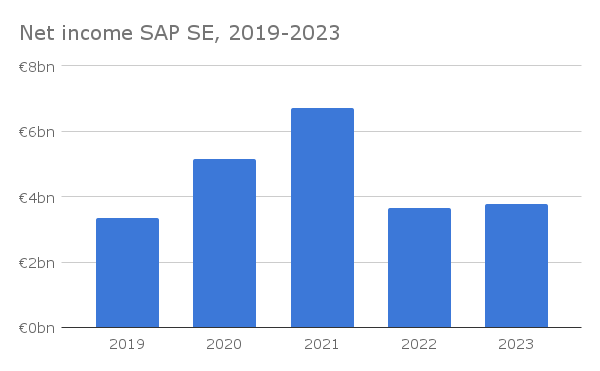

- Not every case is as clear-cut and simple as this one. Take a look at the net earnings of SAP a leading enterprise software company. Could you confidently say whether or not that company has an upward trend over the last five years from looking at the numbers or the chart?

| in €1000 | 2023 | 2022 | 2021 | 2020 | 2019 |

| Net income | 3,776,000 | 3,643,000 | 6,703,000 | 5,145,000 | 3,337,000 |

Using the formula approach we can easily find that their net income is currently not showing an upward trend:

- Average net income = €4.52bn

- Net income slope = -€62m

- Net income growth = -1.4%

Analyzing the balance sheet

The balance sheet is the second of the three financial statements to analyze. In contrast to the income statement it doesn’t show the performance during a period of time but a snapshot of a company’s financial condition at a point in time, typically at the end of the business year. From the balance sheet, we seek the following information:

- Long term debt

- Total liabilities

- Retained earnings

- Treasury stock

- Ordinary shares number

- Shareholder’s equity

From these inputs, we will compute 5 performance indicators that will help us gauge the potential of the company by answering these questions:

- Is the amount of debt the company has small compared to its earnings and its equity?

- Is the amount of retained earnings growing over time?

- Do share buybacks exist?

- Is the return on equity high?

Long term debt to earnings ratio

- What is it: Debt is borrowed money. A company may use a loan (or issue bonds) to finance a huge project or they might use debt to reduce their tax burden. Long term debt are liabilities that mature in more than 12 months (as opposed to current liabilities, which are due in 12 months or less)

- How to compute it: Long term debt can be read from the balance sheet. We find it in the liabilities section under non-current liabilities. Earnings are the net income we have used in the previous section to compute net margin.

- Why it is important: Debt-financing has its advantages (to reduce taxes or to protect against leveraged buyouts). However, all that debt has to be paid back one day, including interest. And that money has to come either from the money the company earns with its operations or refinanced with new debt. Thus, less is more when it comes to debt.

- What we are looking for: The lower the better. While a small amount of debt can be healthy, great companies don’t need a lot of it. A debt-to-earnings ratio of less than 4 is good, a value smaller than 2 is great. What that means is that a company could pay back all their outstanding long term debt with their earnings within 4 years or less, giving them more agility in responding to changes in the economic environment, for instance when interest rates rise.

Turning to our running example Visa, we find that they have a great long term debt to earnings ratio: The average over the last 4 years is only 1.52, i.e. they could pay it all back within 18 months if they wished to do so. We also see that the ratio is decreasing over time. This is due to a relatively steady amount of debt while earnings are rising (about 16% per year as we found out in the last section).

| in $1000 | 2023 | 2022 | 2021 | 2020 |

| Long term debt | 20,463,000 | 20,200,000 | 19,978,000 | 21,071,000 |

| Earnings | 17,273,000 | 14,957,000 | 12,311,000 | 10,866,000 |

| Debt to earnings ratio | 1.18 | 1.35 | 1.62 | 1.94 |

Total liabilities to equity ratio

- What is it: Total liabilities is the sum of all liabilities a company has – current and non-current. Equity is the “net worth” of the company. You get it when you subtract liabilities from assets.

- How to compute it: Both, total liabilities and shareholder’s equity, can be read directly from the balance sheet. On Yahoo finance they are called “Total liabilities net minority interest” and “Stockholder’s equity”. There is a twist, though. Great companies have so much earnings power that they don’t need to carry a lot of equity on their balance sheet. Instead, they use their earnings to buy back shares, which increases their control over their company and also improves their per share earnings. That makes the company look more successful in the market. In order to account for this, we need a modified denominator for our indicator. The key is to add “Treasury stock” to the shareholder’s equity. In the end, this is how the shares that the company bought back are listed on the balance sheet. You can find it in the “Total equity” section on the balance sheet – the same location as for shareholder’s equity. Thus, our equation becomes total liabilities divided by the sum of shareholder’s equity and treasury stock.

- Why it is important: Companies need money to finance their operations. And that money can come from two sources: debt or earnings. Great companies with a competitive advantage will use their earnings power to finance operations, and hence will likely have high equity and low liabilities. The opposite is true for companies without a strong advantage. They will have to depend much more on debt for financing, and hence will have higher levels of liabilities and lower levels of equity.

- What we are looking for: The lower the better. A value of less than 1.5 is good. A value smaller than 0.8 is great.

After pulling the data from Yahoo finance, we can easily see that our running example Visa has a decent total liabilities to equity ratio of 1.29:

| in $1000 | 2023 | 2022 | 2021 | 2020 |

| Total liabilities | 51,766,000 | 49,920,000 | 45,307,000 | 44,709,000 |

| Shareholder’s equity | 38,733,000 | 35,581,000 | 37,589,000 | 36,210,000 |

| Treasury stock | 0 | 0 | 0 | 0 |

| Liabilities to equity ratio | 1.34 | 1.40 | 1.21 | 1.23 |

A company with an exceptionally great ratio (0.36) and the special case of having low equity but a high amount of treasury stock is Adobe:

| in $1000 | 2023 | 2022 | 2021 | 2020 |

| Total liabilities | 13,261,000 | 13,114,000 | 12,444,000 | 11,020,000 |

| Shareholder’s equity | 16,518,000 | 14,051,000 | 14,797,000 | 13,264,000 |

| Treasury stock | 28,129,000 | 23,843,000 | 17,399,000 | 13,546,000 |

| Liabilities to equity ratio | 0.30 | 0.35 | 0.39 | 0.41 |

Retained earnings

- What is it: A company can do one of three things with its earnings

- Pay a dividend to shareholders

- Buy back shares

- Retain them to grow the business

- How to compute it: Retained earnings can be read directly from the balance sheet on Yahoo finance in the equity section.

- Why it is important: The net earnings that the company doesn’t spend on dividends or share buybacks accumulate over time and give the company funds that it can reinvest into growing its business, e.g. for better equipment, R&D, marketing or acquisitions. And these investments can generate additional earnings in the future – a virtuous cycle of continued growth that increases the net worth of the company over time.

- What we are looking for: As with net income, we want to see retained earnings grow. While the actual rate of growth can also be a valuable indicator, in order to keep things simple, our primary interest is to know if the retained earnings are growing at all, i.e. do they show an upward trend. We can use the same technique for determining the growth rate that we have already used to assess net income growth (see the section “Net income and net margin” for a step by step description). Doing that we easily find that the company we are analyzing shows healthy growth in retained earnings – strong performance on yet another indicator.

| in $1000 | 2023 | 2022 | 2021 | 2020 |

| Retained earnings | 18,040,000 | 16,116,000 | 15,351,000 | 14,088,000 |

- Average retained earnings = $15.90bn

- Slope of retained earnings = $1.26bn

- Retained earnings growth = 7.9%

Share buybacks

- What is it: It is simply a company buying back its own shares from the marketplace. This usually happens when it has a lot of excess cash at hand (from great earnings). There are several potential motivations for this:

- “Financial engineering”: Taking the shares off the market reduces the number of outstanding shares, total assets as well as equity. Thus, a lot of important financial indicators – like earnings per share, return on assets or return on equity – look “better” because the denominator in the ratio is made smaller.

- Buying shares when the company believes they are undervalued and hence “cheap”.

- Reducing the number of publicly available shares to increase the value and voting power of the remaining shares, especially those held by insiders, such as the founders of the company. In some cases this can also be a tax efficient way to put cash back into shareholder’s hands.

- How to compute it: Treasury stock is listed explicitly on the balance sheet in the equity section next to shareholder’s equity and retained earnings. On the same page, at the very bottom of the table, Yahoo finance also lists the number of treasury shares ( if they exist) and ordinary shares. When combined they give us the total number of shares.

- Why it is important: Whatever the motivation, a company can only buy back shares when it has the free cash at hand and no better alternative to spend it ( i.e. dividends, investments). The key point is the excess cash, which is indicative of a great business.

- What we are looking for: We want to know if share buybacks exist.That is first and foremost indicated by the presence of treasury stock. If there is no treasury stock but the total number of shares is reducing over time, it is a similarly valuable signal. In that case, the company canceled the shares after repurchasing them rather than holding them in their treasury.

For our example Visa, we see that they don’t hold any treasury stock. In addition, the number of ordinary shares is fluctuating mildly around an average value of 2.11bn and also doesn’t provide a strong signal indicative of share buybacks ( with the intent of immediate cancellation)

| in 1000 | 2023 | 2022 | 2021 | 2020 |

| Treasury stock | 0 | 0 | 0 | 0 |

| Treasury shares | 0 | 0 | 0 | 0 |

| Ordinary shares | 2,068,028 | 2,112,583 | 2,143,028 | 2,120,446 |

The counterexample to this is Apple, a company that has been known for years for its massive share repurchase program. Even though we also don’t find any treasury stock, we see a rather constant reduction in shares by about 3% per year.

| in 1000 | 2023 | 2022 | 2021 | 2020 |

| Treasury stock | 0 | 0 | 0 | 0 |

| Treasury shares | 0 | 0 | 0 | 0 |

| Ordinary shares | 15,550,061 | 15,943,425 | 16,426,786 | 16,976,763 |

A final example can be found in Procter & Gamble, a company that holds approximately 41% of the shares that were once issued in its treasury.

| in 1000 | 2023 | 2022 | 2021 | 2020 |

| Treasury stock | $129,736,000 | $123,382,000 | $114,973,000 | $105,573,000 |

| Treasury shares | 1,647,100 | 1,615,400 | 1,579,500 | 1,529,500 |

| Ordinary shares | 2,362,100 | 2,393,800 | 2,429,700 | 2,479,700 |

Return on equity

- What is it: Return on equity is a measure of profitability. It measures how efficiently a company’s management can utilize its resources (equity) to generate profits.

- How to compute it: Return on equity is the net income (from the income statement) divided by shareholder’s equity (from the balance sheet). Recalling the effect that share buybacks can have on return on equity, i.e. making it look better than it is, we have to consider treasury stock: If a company has small or negative equity and a comparably large amount of treasury stock, we have to add in the latter to get a less distorted view of its performance.

- Why it is important: A high return on equity means that the company is making good use of the earnings it is retaining by turning them into future profits. After all, we are looking for a return on our investment, and in the long run the company’s stock price can’t grow much faster than its ability to create returns from their capital.

- What we are looking for: The higher the better. A return on equity of 15% or more is already good. More than 25% are a great result and a strong indicator of a durable competitive advantage.

For our running example Visa we see an exceptional return on equity: An average of 37% over the past four years and as a bonus a clear upwards trend. Other companies from different industries with a comparably high return on equity are Adobe with 35% or Philip Morris International with 34%. The latter is also a great showcase of the potentially distorting effect of negative equity and treasury stock.

| in $1000 | 2023 | 2022 | 2021 | 2020 |

| Net income | 17,273,000 | 14,957,000 | 12,311,000 | 10,866,000 |

| Shareholder’s equity | 38,733,000 | 35,581,000 | 37,589,000 | 36,210,000 |

| Return on equity | 44.6% | 42.0% | 32.8% | 30.0% |

| in $1000 | 2023 | 2022 | 2021 | 2020 |

| Net income | 5,428,000 | 4,756,000 | 4,822,000 | 5,260,000 |

| Shareholder’s equity | 16,518,000 | 14,051,000 | 14,797,000 | 13,264,000 |

| Return on equity | 32.9% | 33.8% | 32.6% | 39.7% |

| in $1000 | 2023 | 2022 | 2021 | 2020 |

| Net income | 7,813,000 | 9,048,000 | 9,109,000 | 8,056,000 |

| Shareholder’s equity | -11,225,000 | -8,957,000 | -10,106,000 | -12,567,000 |

| Return on equity | -69.6% | -101.0% | -90.1% | -64.1% |

| Treasury stock | 35,785,000 | 35,917,000 | 35,836,000 | 35,129,000 |

| Adjusted equity | 24,560,000 | 26,960,000 | 25,730,000 | 22,562,000 |

| Return on adjusted equity | 31.8% | 33.6% | 35.4% | 35.7% |

Analyzing the cash flow statement

The cash flow statement describes – quite literally – how cash flew in and out of the company during a period of time. It is divided into sections that describe the different aspects of running and managing a business: operating, investing and financing activities. It complements the other two financial statements we are analyzing and provides additional insight into the financial health of the company and the short-term viability of the business. An important aspect of short term viability is liquidity: Does the company have enough cash to pay its bills? While that is particularly interesting for accounting personnel and creditors, for our purpose of evaluating a company as a potential investment, we are interested in another figure: capital expenditures.

CapEx to earnings ratio

- What is it: Capital expenditures (CapEx) are the money a company uses to purchase, maintain or improve its fixed assets, such as purchasing land or equipment. They are distinguished from operating expenses, which are expenses needed to support the running operations. The latter appear on the income statement (as costs) while the former appear on the balance sheet (as capitalized assets). Once more, the time frame plays an important role here: if the useful life of the item purchased is more than one year, it is a capital expenditure. We can thus see it as investments into the infrastructure of the company that is necessary to produce its goods or services.

- How to compute it: Capital expenditures can be read directly from the cash flow statements. Earnings are the net income we have already touched upon in the previous section on net income and net margin. What we are interested in is the ratio between capital expenditures and earnings to put the absolute numbers into a useful perspective.

- Why it is important: When a company is forced to use large amounts of money every year in order to keep its business running (e.g. purchasing vehicles, machines or other necessary equipment) those expenses pose a financial risk. In good years, the company may well be able to pay all of that out of its earnings. However, when earnings are too low to cover these expenses, the company needs to resort to debt financing or eat into its cash reserves. And new debt plus the interest ultimately needs to be paid back one day with future earnings.

- What we are looking for: The lower the better. Having capital expenditures that are less than 50% of earnings is good. A ratio of 25% or less is great and likely indicative of a durable competitive advantage. Note: When you read CapEx from the cash flow statement it is a negative number because it is an expense. Thus in a fictional example of a company having earnings of $10M and capital expenditures of $2M, the ratio would be -2 / 10 = -0.2 which is equivalent to a CapEx to earnings ratio of 20%, and hence a great performance.

Once again, our example company Visa is a poster child for low capital expenditures – spending on average less than 7% of its earnings every year. On the contrary the car manufacturer BMW spent on average 72% of its earnings on capital expenditures during the last 4 years. We also see the case of CapEx exceeding earnings in 2020 – likely the impact of the COVID pandemic, forcing plants and dealers to shut down and car sales dropping across the globe.

| in $1000 | 2023 | 2022 | 2021 | 2020 |

| Capital expenditure | -1,059,000 | -970,000 | -705,000 | -736,000 |

| Net income | 17,273,000 | 14,957,000 | 12,311,000 | 10,866,000 |

| CapEx to earnings ratio | -6.1% | -6.5% | -5.7% | -6.8% |

| in €1000 | 2023 | 2022 | 2021 | 2020 |

| Capital expenditure | -10,881,000 | -9,050,000 | -6,619,000 | -6,150,000 |

| Net income | 11,290,000 | 17,941,000 | 12,382,000 | 3,775,000 |

| CapEx to earnings ratio | -96.4% | -50.4% | -53.5% | -162.9% |

Putting it all together to assess a company

Let’s do a quick recap of what we have accomplished already:

- We went through the three financial statements (income statement, balance sheet, cash flow statement) and pulled out the information that is relevant for our analysis.

- Based on that data, we computed the performance indicators we need to value the potential of the company for a successful investment.

- And we already assessed the actual performance against target values that would suggest that a company has a competitive advantage, which can present a great opportunity for investment.

Performance profile

What is left for us to do, is to summarize that information into a single score that will aid our decision about whether or not to consider a company for investment. Let’s do this by summarizing what we have learned about our running example Visa:

| Performance indicator | Metric | Value |

| Gross margin | Average | 79.8% |

| Gross margin | Coefficient of variation | 0.6% |

| SG&A expense rate | Average | 13.2% |

| Net income | Growth | 15.8% |

| Net income | Consistency | yes |

| Net margin | Average | 51.2% |

| Long term debt to earnings ratio | Average | 1.52 |

| Total liabilities to equity ratio | Average | 1.29 |

| Retained earnings | Growth | 7.9% |

| Share buybacks | Existence | no |

| Return on equity | Average | 37.3% |

| CAPEX to earnings | Average | -6.3% |

Performance scoring

The other ingredient we need to compute the final score are the performance targets for each indicator, i.e. the performance values that we would like to see in a company to make it an opportunity for a good investment. They fall into one of two categories:

- Performance values that we assess with a single condition, such as net income growth: If a company shows growth, we give it one point.

- Performance values where we can further differentiate between good and great performance, such as the gross margin: If the value exceeds the threshold for good performance, the company gets one point and if it exceeds the threshold for great performance we award it two points.

Below is a summary of the these performance targets:

| Metric | great = 2 points | good = 1 point |

| Avg. gross margin | >40% | >20% |

| Avg. SG&A expense rate | <30% | <70% |

| Avg. net margin | >20% | >10% |

| Avg. long term debt to earnings ratio | <2 | <4 |

| Avg. total liabilities to equity ratio | <0.8 | <1.5 |

| Avg. return on equity | >25% | >15% |

| Avg. CapEx to earnings ratio | <25% | <50% |

For the remaining metrics we award one point when the following conditions are met:

- The coefficient of variation of the gross margin is less than 10%

- The net income growth is greater than 1%

- There have been no years with negative net income (aka no losses)

- The retained earnings growth is greater than 1%

- Share buybacks exist, indicated by either a significant amount of treasury stock and / or a reduction in total shares number

Putting it together, we find that a company can achieve a score between 0 (failing all criteria) and 19 (satisfying all criteria). I tend to normalize the raw score by dividing the actual score by the maximum possible score, providing a final score in the range between 0 and 100%. The last element we need for our analysis is a decision threshold, i.e. a number above which we consider a company’s performance to be good enough to warrant further analysis. This is a personal decision every investor has to make and has an inherent trade-off:

- Setting the threshold too low means that there will be many companies that pass the filter. Doing a full analysis on all of them can become prohibitively time-consuming and may offer little benefit, because many of these low-scoring companies will likely not make it through to the end of the analysis.

- Setting the threshold too high means that only very few excellent companies will pass through this filter. Thus, while we subject only the most promising candidates to a full analysis, we may miss some valuable opportunities.

Personally, I settled on a threshold of 80% – achieving at least 15 out of 19 points (which is 78.94% to be precise). That gives me confidence that the companies that make it through this filter have great potential and the effort that I put into the subsequent analysis will be time well spent because the hit rate, i.e. the number of companies that I will analyze in detail and that do turn out to be great investment opportunities, will be high.

Verdict

For our running example Visa we find that it achieves a final score of 89% (17 out of 19 possible points). That is an excellent score, above our threshold of 80% and a strong signal that the company enjoys a competitive advantage and presents a great investment opportunity that warrants more detailed analysis.

| Performance indicator | Metric | Value | Score | Explanation |

| Gross margin | Average | 79.8% | 2 | is above 40% |

| Gross margin | Coefficient of variation | 0.6% | 1 | is below 10% |

| SG&A expense rate | Average | 13.2% | 2 | is below 30% |

| Net income | Growth | 15.8% | 1 | is above 1% |

| Net income | Consistency | yes | 1 | no losses |

| Net margin | Average | 51.2% | 2 | is above 20% |

| Long term debt to earnings ratio | Average | 1.52 | 2 | is below 2 |

| Total liabilities to equity ratio | Average | 1.29 | 1 | is between 0.8 and 1.5 |

| Retained earnings | Growth | 7.9% | 1 | is above 1% |

| Share buybacks | Existence | no | 0 | no treasury stock or reduction in shares |

| Return on equity | Average | 37.3% | 2 | is above 25% |

| CAPEX to earnings | Average | -6.3% | 2 | is below 25% |

| Total score | 89% | 17 out of 19 possible points |

Ultimately there are more factors to consider before making an actual investment, such as

- Does the company outperform competitors?

- Is it undervalued (aka cheap) based on the future cash flows we expect it to produce?

- Is it undervalued compared to other companies in its industry based on relative valuation using multiples?

- Does it have a moat and can we develop a strong narrative or thesis about why we expect this company to be a good (long term) investment?

Conclusion

Assessing the performance of a company by analyzing its financial statements using freely available data is an effective and quick first step in separating the wheat from the chaff that will save us time and effort by enabling us to focus our efforts on only the most promising opportunities. Given the length of this article, it might seem odd to think of this method as “quick”. And it is true that it can take some time to internalize the concepts at first and get familiar with retrieving and assessing the data. However, the process can be sped up a lot by using spreadsheet templates, so one only has to fill in the data and have all the calculations done automatically. Done that way, it takes less than 5 minutes to perform the entire analysis from start to finish. For a full universe of blue chip stocks such as the Dow Jones Global Titans 50 this amounts to less than half a day to assess the entire basket and identify the dozen or so stocks that present potentially promising investment opportunities.

Disclaimer: The content on this page is for informational and educational purposes only and does not constitute financial, investment, or trading advice. All opinions expressed are solely those of the author. There are risks associated with investing in securities, including the loss of invested capital. Past performance is not a guarantee or predictor of future results. The author is not responsible for any losses incurred as a result of the information provided.